TaxCloud x Bonanza: Understanding Sales Tax and the Need for Automation

Most US states and several countries worldwide have added Marketplace Facilitator Provisions to their sales tax laws. Bonanza is considered a Marketplace Facilitator, and is therefore responsible for calculating, collecting, and remitting tax for all sales made to buyers located in specific states, regardless of the seller's location.

Sales Tax on Bonanza: https://support.bonanza.com/hc/en-us/articles/360029034131-Sales-Tax-Bonanza

As a seller, we understand that sales tax can be confusing when you’re having to account for different state rules and taxes for different types of items. Compliance with sales tax laws is essential for businesses to avoid penalties and ensure smooth operations.

As online sales continue to grow, understanding and managing sales tax obligations has become increasingly significant for sellers, impacting pricing strategies, profit margins, and overall customer experience.

Over the past many years, Bonanza has partnered with TaxCloud to provide you with peace of mind when it comes to calculating and collecting sales tax from your Bonanza sales!

Bonanza will collect and remit sales tax on behalf of sellers for all applicable transactions where the buyer is located in the states listed here (regardless of the seller's location).

Our partner, TaxCloud, will calculate the tax amount based on the type of product, the buyer’s location, and the location from which the item is shipped. Bonanza will then remit the sales tax to those states through our partnership with TaxCloud.

To learn more about this integration, check out this Bonanza x TaxCloud Webinar: https://drive.google.com/file/d/1graI3kR6DOgSDHKx3spxmLafs-086pdP/view

<< Back

Recent Posts

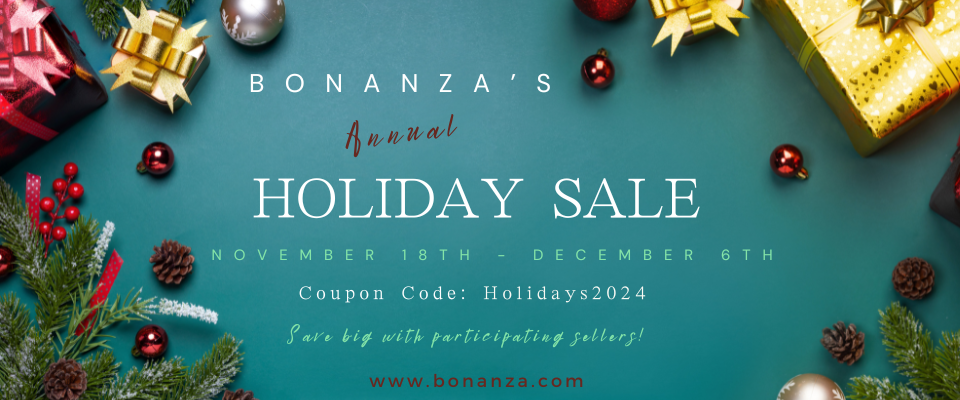

It's TIME! Bonanza's Annual Holiday Sale is coming up!

Nov 13, 2024

Veteran's Day: Honoring Service and Sacrifice

Nov 11, 2024

Holiday Support for Your Bonanza Business—Big Savings & Bigger Opportunities

Oct 4, 2024

Bonanza and TaxCloud: A Game-Changing Partnership

Sep 30, 2024

Exciting News for Bonanza Sellers: Introducing Bonanza Ads!

Sep 25, 2024

3 responses to TaxCloud x Bonanza: Understanding Sales Tax and the Need for Automation

The most needed and appreciated service ever provided by an online sales site!

Thanks, but I don’t see any “states listed above.” Where is that, exactly?

You can find the full list of states here: https://support.bonanza.com/hc/en-us/articles/360029034131-Sales-Tax-Bonanza#taxCheckout

Thanks for asking!

Login to see more comments